Background Traxia

One day around the world is about $ 43 trillion accounts accounts receivable or trade payables, where the bank only finances about $ 3 trillion of the total (Kemper, 2016). At a detailed level, there is a gap in it.

Global trade finance of about $ 1.6 trillion, mostly from Asian firms (Asia Development Bank, 2016). The International Chamber of Commerce refers to trade.

Financing as an 'oil' in international trade machines and highlights are not being met, demand for such financing (International Chamber of Commerce, 2017).

This gap is the result of misalignment in terms of demand for related trade credit and liquidity of funds provided. It is not available proportionately multinational companies and large corporations - the top end of the market - and are consistently absent in the segment of SMEs (International Chamber of Commerce, 2017). Just tell me, the SME's.

Faced with few choices in addition to accepting the terms of payment of their large customers, no problem

how hard they are. Financial Technology (FinTech) company has come up with a solution to this gap in global trade finance. However, in the absence of new instruments and markets that connect and bring together different trade actors, new businesses have Can not make a big difference.

The current trade finance gap is caused by the following key issues (International Monetary Fund, 2016):

1. Absence of trust and cooperation between banks the continuous decline in correspondent banking relationships has led to The economic fragility that has not been compensated by the limited growth of open account financing or Letters of Credit (L / C).

2. Limitations of transparency due to the lack of reliable data ipoints throughout the trade financing value chain In periods formed by lack of trust and transparency, trade finance actors (private banks, export credit agencies, and regional development) banks) seem to collect their resources (World Trade Organization, 2008) which creates difficulties in terms of obtaining a comprehensive and reliable data on such trade finance transactions.

3. Limited Cash Liquidity in the market and higher spreads the big banks have reported some incidents that lack access to competitive funding has cost them a lot financial trading operations.

4. Bureaucracy and endless documents digitalization in trade finance is far from mainstream. Provider has promised digital letters of credit and bill of lading for years, but most corporations and banks still exchange paper documents (International Chamber of Commerce, 2017) SMEs account for GDP and employ two-thirds of the global workforce (World Economic Forum, 2015). Number one barrier for the growth facing SMEs around the world is access to finance (International Labor Office, 2015). This is not a new issue and the 2008 financial crisis only exacerbates the problem.

Many local retail banks, which are often the primary and sole providers of SME financing, have lost their appetite for taking high-risk SME loans. Estimated SMEs facing 2015 global credit limit of $ 2 trillion USD (World Economic Forum, 2015).

SMEs account for more than one-half of the world's GDP and employ two-thirds of the global workforce (World Economic Forum, 2015). The number one barrier to growth faced by SMEs around the globe is access to financing (International Labor Office, 2015). This is not a new issue and the 2008 financial crisis only worsened the problem. Many local retail banks, SME loans, have lost their appetite for taking on higher-risk SME loans. It is estimated that SMEs faced in 2015 a $ 2 trillion USD global credit gap (World Economic Forum, 2015).

FOR WHAT ARE YOU?

In our Ecosystem Seller uploads the invoice, the Buyer undertakes the smart contract, the Liquidity Provider ensures liquidity, the Investor redeems the newly created digital assets.

WHAT IS TMT TOKEN?

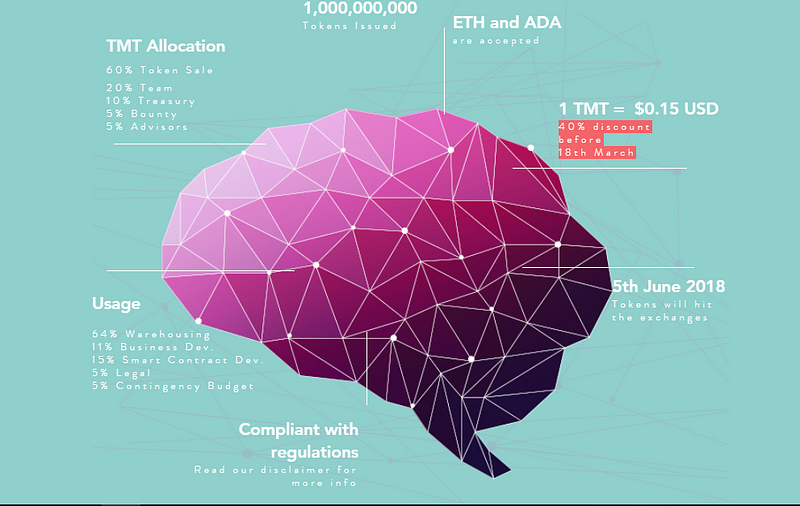

Token Membership Trauma (TMT) is a utility token issued by the Traxia Foundation (Swiss law) that provides access to our ecosystem.

Each time the Publisher Provider adds a new invoice to the system, TMT must be purchased by way of exchange to complete the access fee.

The price for the TMT will reduced during the pre-Sale and early sale:

Pre-sale:

- 220.000.000 TMT

- 40% Discount

- 19.800.000 max. USD

Token sale week 1:

- 180.000.000 TMT

- 20% Discount

- 21.600.000 max. USD

Token sale week 2:

- 180.000.000 TMT

- 10% Discount

- 24.300.000 max. USD

Token sale week 3:

- 180.000.000 TMT

- 0% Discount

- 27.000.000 max. USD

Roadmap Traxia

Product Architecture and Development Roadmap:

V1 (alpha) January 2018

V1 (beta) March 2018

Monolith API (PHP), web clients (Angular 4 / Typescript)

V2 April 2018

Monolith API (PHP), web clients (Angular 4 / Typescript)

V3 June / July 2018

Microservice API (NodeJS/Typescript/GraphQL), webclient

(ReactJS/Typescript/Redux), mobileclient (React Native/Typescript/Redux)

For more information please follow this link:

Website: https://www.traxia.co/

Whitepaper: https://docs.wixstatic.com/ugd/baba69_30f719c55f344ab7ae44715a4d287811.pdf

Telegram Group: https://t.me/traxiafoundation

Official Bitcointalk thread: https://bitcointalk.org/index.php?topic=3019695.new#new

Bounty Bitcointalk thread: https://bitcointalk.org/index.php?topic=3021679.0

Website: https://www.traxia.co/

Whitepaper: https://docs.wixstatic.com/ugd/baba69_30f719c55f344ab7ae44715a4d287811.pdf

Telegram Group: https://t.me/traxiafoundation

Official Bitcointalk thread: https://bitcointalk.org/index.php?topic=3019695.new#new

Bounty Bitcointalk thread: https://bitcointalk.org/index.php?topic=3021679.0

Komentar

Posting Komentar